As urgent care centers face an increasing demand for services, reducing patient wait times has become a top priority. Long wait times not only affect patient satisfaction but also indicates operational inefficiencies and can result in revenue loss. The question that we face next is, what will it take to reduce patient wait times and correspondingly enhance the overall patient experience? Below is the 5S framework strategy that can significantly reduce wait times and improve operational efficiency.

Streamlined Pre-Registration and Online Check-In

Did you know that online check-in can save a patient up to 16 minutes[1] sitting in the waiting room?

With the rise of digital technologies, pre-registration and online check-in systems are revolutionizing the way urgent care centers operate. By enabling patients to complete their details and necessary paperwork remotely, healthcare providers can eliminate front-desk bottlenecks, allowing staff to focus on providing timely care.

Integrating an Electronic Medical Record (EMR) portal into the online system further enhances this process. Patients can update personal information, schedule or change appointments, get e-reports, and even join the queue before arrival. Additionally, automated text reminders keep patients informed about appointment details, reducing confusion and improving overall time management. This seamless digital experience not only minimizes wait times but also empowers patients to manage their appointments with ease.

Virtual Queue Management

Imagine knowing exactly how long your wait will be before you even walk into the clinic. Virtual queue management can make this a reality. Studies show that 83% of patients experience less frustration when they know what to expect regarding wait times.[2]

The adoption of virtual queue management can enable patients to reserve a spot, get information about expected wait time, room availability, and wait remotely, significantly decreasing overcrowding in waiting areas. By integrating this advanced scheduling software, healthcare providers can seamlessly manage patient data, categorize appointments based on urgency, and prioritize critical cases effectively. Dynamic scheduling further enhances this process by allowing real-time adjustments for cancellations and no-shows, ensuring optimal utilization of available time slots. Automated appointment reminders via SMS/email serve as an additional layer of efficiency, reducing no-show rates and maintaining a more predictable schedule. Additionally, incorporating the automated queue management portal with digital display systems on the center can further minimize the need for additional staffing, further streamlining operations.

Streamlined Triage Process

A streamlined triage process is key to reducing wait times and ensuring that patients receive timely and appropriate care. Prioritizing urgent cases right from the start ensures that critical patients aren’t delayed. The implementation of standardized triage protocols guarantees consistency and efficiency in patient assessments, helping reduce variability and avoid delays in treatment.

By leveraging digital tools like online symptom checkers, AI-driven triage systems, and telehealth services, healthcare providers shall accelerate the triage process. AI-based systems can analyze vital signs, medical history, and symptoms to assess acuity levels and predict potential complications, facilitating quicker decision-making. This reduces in-person wait times, ensures rapid assessments, and prevents bottlenecks. Moreover, AI-integrated systems that connect with Electronic Health Records (EHRs) ensure that data is readily available for informed decision-making in real time. This rapid assessment process can quickly categorize patients based on the severity of their conditions. Self-service kiosks can also aid the triage process, allowing patients to check in, report symptoms, and get assessed without further delays at the front desk while allowing medical professionals to focus on delivering care. The combination of AI and digital tools enables urgent care centers to provide timely care and improve patient satisfaction.

Patient Volume Forecasting

Accurate forecasting of patient volumes based on historical data analysis and seasonal & daily variation trends in patient volumes can plays a crucial role in proactive resource planning. A high accuracy level in forecasting can help an Urgent Care Center in preparing for demand fluctuations by allocating adequate staff and medical equipment to cater to the expected volumes. It also helps in allocating appointment slots according to projected demand and capacity constraints. This would have a. direct impact on patient wait times.

Using data to strengthen overall workflow

Data is crucial in identifying inefficiencies and optimizing workflows. By implementing robust data collection and analytics systems, urgent care centers can make strategic decisions that reduce wait times and improve overall operational efficiency. Tracking key process measures such as wait times, treatment durations, and staff utilization as well as tracking flow of patients across work centres/activities can help in uncovering bottlenecks that might be causing delays leading to higher waiting times. It would also help in focusing on improving the bottleneck activities leading to direct reduction in overall cycle time and corresponding wait times.

Conclusion

Are You Ready to Take the Next Step in Reducing Wait Times?

Reducing patient wait times in urgent care centers requires a comprehensive approach—incorporating technology, staff training, and data analytics to optimize patient flow. At Navikenz, we specialize in digital transformation solutions that can revolutionize how healthcare providers operate. From automating patient flow to using AI-powered scheduling and predictive analytics, we offer the expertise necessary to help your urgent care facility achieve seamless operations and deliver an exceptional patient experience.

Are you ready to improve your urgent care center’s efficiency? What will it take to give your patients the best experience, while also optimizing your operations?

Get in touch with us today to explore the future of urgent healthcare management at info@navikenz.com.

References:

[1] https://docresponse.com/blog/how-to-reduce-patient-wait-times/

[2] https://www.unotech.io/5-simple-tips-to-reduce-patient-waiting-time-in-clinics

https://lonestaruc.com/articles/7-best-strategies-to-reduce-care-wait-times/

https://www.wavetec.com/blog/healthcare/improve-patient-flow-in-urgent-care/

https://www.dezyit.com/post/boosting-triage-efficiency-in-healthcare-the-role-of-ai

Urgent care centers operate in a fast-paced, high-demand environment where patient influx can be unpredictable. Managing this demand efficiently requires accurate patient load forecasting. A mismatch between anticipated and actual patient volumes can lead to overcrowding, long wait times, staff burnout, and a decline in patient satisfaction.

The key question for urgent care providers is: How accurate is your patient load forecasting, and how is it impacting your operations?

Is Your Patient Load Forecasting on Track?

Understanding whether your current forecasting methods are effective is crucial. Are you frequently experiencing patient surges that can’t be handled? Do you often have idle staff due to overestimation? Forecasting mismatch can impact both quality of care and financial stability. If your predictions are missing the mark, it’s important to evaluate your forecasting models.

Understanding Typical Patient Load in Urgent Care Centers

In 2022, the UCA Operations Benchmarking Report revealed that the median patient volume for an urgent care center was 56 patients per day[1]. This number can fluctuate based on location, season, and specific healthcare trends. On weekdays, urgent care centers typically see the highest patient load on Monday mornings, with a gradual decrease throughout the week, often experiencing a slight uptick in patient volume on Friday afternoons. During flu season or viral outbreaks, patient volumes can increase by up to 40%[2], overwhelming the system if not properly managed. The demand also tends to peak in the evenings after regular work hours. Understanding these patterns is essential for strategic staffing, inventory planning, and operational efficiency.

Effect on Patient Satisfaction Due to Mismatch in Patient Volume Forecasting

One of the key drivers behind the growing popularity of urgent care centers is their ability to deliver superior patient experience. In an industry often characterized by complex navigation and long wait times, urgent care centers stand out by offering convenience and efficiency. A significant mismatch between anticipated and actual patient volumes can directly impact patient satisfaction in urgent care centers. When patient demand exceeds expectations, understaffing leads to long wait times, rushed consultations, and overwhelmed healthcare providers, resulting in a subpar patient experience. Conversely, overestimating patient volume can lead to inefficient resource utilization, causing unnecessary operational costs without improving service delivery. Patients expect quick and seamless care from urgent care centers, and any disruption whether in the form of extended wait times, lack of available providers, or disorganized workflows can lead to frustration and lower satisfaction scores. Research by American Journal of Managed Care shows that patient satisfaction is highly correlated with wait times and provider engagement[3]; thus, an inaccurate forecasting model can significantly erode trust and loyalty, ultimately affecting repeat visits and word-of-mouth referrals.

Effect of Accurate Patient Load Forecasting

Accurate patient load forecasting is essential for optimizing operations in urgent care centers, directly influencing patient satisfaction, resource allocation, and financial performance. By leveraging historical data, seasonal trends, and AI-driven predictive analytics, UCCs can anticipate patient demand with greater precision. A well-calibrated forecasting model ensures optimal staffing levels, reduces patient wait times, and enhances the overall quality of care. For instance, research indicates that utilizing predictive models can lead to a reduction in emergency department delays by up to 15%.[4] Additionally, a study focusing on urgent care clinics found that machine learning algorithms improved patient volume forecasting accuracy by approximately 23-27% over traditional methods.[5]

Achieving high accuracy in patient load forecasting involves integrating real-time data, considering external factors such as seasonal illnesses or local events, and continuously refining predictive models. Centers adopting advanced forecasting techniques have reported significant improvements in operational efficiency and patient satisfaction. Therefore, embracing sophisticated forecasting methodologies is crucial for urgent care centers aiming for operational excellence and enhanced patient care.

Conclusion: How Is Your Urgent Care Center Performing?

Given the direct impact of forecasting accuracy on wait times, NPS, and overall center performance, it’s crucial to ask:

- Are your patient volume predictions aligning with actual demand?

- How is your forecasting accuracy affecting patient satisfaction and attrition?

At Navikenz, we drive digital transformation to enhance patient load forecasting. Our solutions assist urgent care centers in achieving higher accuracy in demand prediction, enabling better staffing decisions, and improving patient outcomes. If you’re concerned about the accuracy of your patient load forecasting and its impact on your operations, Navikenz can provide an in-depth assessment and tailored solutions to optimize your processes.

Let’s discuss how we can help you improve efficiency and patient care. Contact us at info@navikenz.com.

References:

[1] https://urgentcareassociation.org/wp-content/uploads/2023-Urgent-Care-Industry-White-Paper.pdf

[2] https://www.experityhealth.com/urgent-care-visit-data/

[3] https://www.ajmc.com/view/wait-times-patient-satisfaction-scores-and-the-perception-of-care

[4] https://www.gsb.stanford.edu/insights/predictive-data-can-reduce-emergency-room-wait-times

[5] https://arxiv.org/abs/2205.13067

https://www.immediatecarewestmont.com/what-is-the-busiest-day-of-the-week-for-urgent-care/

Introduction

Agentic AI is transforming how we interact with artificial intelligence. This innovative form of AI autonomously makes decisions and completes complex tasks without constant human oversight. According to Gartner, by 2026, autonomous AI agents will execute 20-30% of enterprise decisions, highlighting their growing importance in the future workplace.

What is Agentic AI?

Agentic AI proactively makes independent decisions using technologies such as machine learning, natural language processing, and automation. Unlike traditional reactive AI, agentic AI actively pursues strategic objectives, including optimizing supply chains or enhancing customer experiences. “Agentic AI represents a fundamental shift in AI capabilities,” says Andrew Ng, founder of Coursera and AI Fund.

It’s actively engaged in strategic decision-making processes rather than simply following pre-programmed instructions. While traditional AI primarily follows explicit instructions and lacks independent judgment, agentic AI autonomously sets goals, makes strategic decisions, and adapts dynamically to changing circumstances.

Key Benefits of Agentic AI

- Efficiency and Optimization: Agentic AI boosts organizational efficiency by optimizing workflows, reducing human error, and significantly increasing productivity. Implementing agentic AI has observed an increase in operational efficiency. For example, Tesla’s autonomous manufacturing systems leverage agentic AI to streamline production processes, reducing downtime.

- Innovation: Agentic AI drives innovation across various sectors by autonomously experimenting and rapidly iterating solutions. “Agentic AI is a driving force behind industry breakthroughs,” remarks Dr. Fei-Fei Li, co-director of the Stanford Institute for Human-Centered Artificial Intelligence. It autonomously generates and tests innovative ideas, significantly accelerating the innovation process. Agentic AI exemplifies by independently exploring thousands of medical data points to identify novel treatments, accelerating drug discovery compared to traditional research methods.

- Enhanced Decision-Making and Trustworthiness: Agentic AI enhances decision-making by independently analyzing and interpreting vast datasets to generate reliable insights. Deloitte research highlights that businesses relying on agentic AI experience a reduction in decision-related errors. AI agents autonomously validate data sources, significantly increasing confidence in business-critical decisions.

Potential Use Cases for Agentic AI

- Customer Service: Agentic AI autonomously resolves customer issues, proactively addressing concerns. For instance, Apple’s Siri leverages agentic capabilities to proactively solve user problems, improving customer satisfaction rates.

- Sales Support: Agentic AI autonomously manages routine administrative tasks, enabling sales teams to prioritize relationship-building activities. Salesforce’s Einstein, an example of agentic AI, autonomously identifies high-value opportunities and has increased sales efficiency.

- Healthcare: Agentic AI autonomously adapts to diverse healthcare environments, interprets emotional cues, and provides personalized patient support. Virtual nursing agents like Care Angel autonomously monitor patient health, reducing hospital readmissions.

- Manufacturing: Agentic AI autonomously monitors and optimizes production processes, predicting equipment failures and minimizing downtime. General Electric’s predictive maintenance AI autonomously forecasts equipment wear, reducing unexpected downtime, resulting in significant cost savings.

Imperatives for Success

To maximize agentic AI’s benefits and manage associated risks, organizations should:

- Define Clear and Achievable Objectives: Establishing specific, measurable, achievable, relevant, and time-bound (SMART) objectives clearly directs agentic AI activities, ensuring strategic alignment and efficiency.

- Ensure Effective Coordination: Optimal collaboration and resource management among multiple AI agents are critical. According to Microsoft’s AI research, coordinated agentic AI frameworks significantly enhance the overall effectiveness of collaborative AI systems.

- Support and Guide Decision-Making: Implement initial safeguards to guide autonomous AI decisions, gradually scaling autonomy as confidence and accuracy increase. Google DeepMind emphasizes progressive autonomy as critical for ensuring safe and beneficial deployment of agentic AI.

Conclusion

Agentic AI holds enormous potential to revolutionize productivity, innovation, and decision-making. However, proactively addressing ethical considerations, biases, and risks remains essential. As Stuart Russell, a prominent AI researcher, advises, “Proactive governance and rigorous oversight are critical to ensuring agentic AI remains beneficial to society.” Early, thoughtful actions will shape the ethical and effective development of agentic AI.

In today’s fast-paced healthcare environment, urgent care centers (UCCs) play a pivotal role in providing immediate medical attention for non-life-threatening conditions. However, patient experiences in these settings often fall short of expectations, leading to dissatisfaction and potential disengagement from essential healthcare services. Dissatisfied patients not only deter potential clientele but also adversely affect the Net Promoter Score (NPS), which is a critical indicator of patient satisfaction and loyalty. Therefore, understanding and addressing the primary factors contributing to negative patient experiences is crucial for UCCs aiming to improve care quality and patient retention.

Prolonged Wait Times

A study by the Urgent Care Association found that 64% of the patients rank wait time as the top reason for leaving an urgent care facility without being seen.[1] The wait time is heavily impacted by a mismatch between anticipated and actual patients. When patient demand significantly exceeds expectations, understaffing leads to long wait times, rushed consultations, and overwhelmed healthcare providers, resulting in a subpar patient experience. The lack of a proper appointment and queue management system further deteriorates the situation. Patients today expect speed and efficiency. If their expectations aren’t met, they get disengaged—impacting footfalls and reviews. Negative patient experiences not only increase attrition but also deter potential new patients from choosing your center.

Staff Behaviour

The demeanor and professionalism of healthcare providers directly influence patient satisfaction. Positive interactions, characterized by empathy, respect, and effective communication, can enhance trust and comfort, leading to improved health outcomes. Conversely, negative behaviours, such as rudeness, dismissiveness, or lack of attention, can result in patient dissatisfaction, increased anxiety, and a reluctance to seek future care. Research by the American Journal of Managed Care shows that patient satisfaction is highly correlated with wait times and provider engagement.[2] A survey by the GMR Web Team in January 2021 revealed unpleasant and rude behavior experiences as the key reason for negative patient sentiment.[3]

Environmental Factors

The physical environment of an urgent care center significantly influences patient satisfaction and recovery. Key elements such as cleanliness, noise levels, lighting, and overall ambiance play crucial roles in shaping the patient’s experience. A clean and well-maintained facility not only reduces the risk of infections but also instills confidence in patients regarding the quality of care they will receive. Conversely, inadequate cleanliness can lead to dissatisfaction and a diminished perception of care quality.

Issues in Billing and Insurance Processing

Billing and insurance processing in urgent care centers are often complex and prone to delays, resulting in significant challenges for both providers and patients. Traditional billing processes can lead to inefficiencies, as urgent care centers often rely on manual data entry and paper-based claims, which increase the risk of errors and delays in processing claims. Sometimes claims are denied in the initial stage due to mistakes in coding or billing, and this causes delays in reimbursement and patient frustration. Moreover, navigating the insurance system can be a headache for patients who may face unexpected out-of-pocket expenses due to lack of transparency or insufficient coverage information. In addition, patients also report confusion or dissatisfaction with how their insurance claims were processed, resulting in lower satisfaction levels and increased complaints. These inefficiencies, coupled with the complex nature of the reimbursement system and the need for prior authorization in some cases, can contribute to negative patient experiences, making it essential for urgent care centers to implement better billing practices and more transparent communication regarding insurance coverage to enhance overall patient satisfaction.

Navikenz excels in process re-engineering and IT solutions to address problems impacting patient satisfaction. With our expertise in digital transformation solutions, we help streamline billing processes, reduce patient wait time, and improve forecasting accuracy. Our data-driven solutions enhance operational efficiency, ensuring a smoother patient journey from check-in to reimbursement. By partnering with Navikenz, you can not only address existing inefficiencies but also elevate your center’s overall patient satisfaction, making it a trusted choice for your community.

Contact us today at info@navikenz.com.

References:

[1] https://www.experityhealth.com/blog/solving-the-top-reason-patients-lwbs-wait-time/

[2] https://www.ajmc.com/view/wait-times-patient-satisfaction-scores-and-the-perception-of-care

[3] https://www.gmrwebteam.com/urgent-care-patient-satisfaction-survey-2021#:~:text=Overall%2C%20the%20Net%20Promoter%20Score,was%2077.30%20/100%20in%202020

https://www.hipaajournal.com/effects-of-poor-communication-in-healthcare/

https://www.kff.org/health-costs/issue-brief/americans-challenges-with-health-care-costs/

Urgent care centers play a vital role in providing accessible and efficient healthcare. However, many of them struggle with revenue losses due to write-offs. These write-offs significantly impact financial stability, reducing profitability and hindering growth. To maintain financial health, urgent care providers must understand the primary causes of write-offs and take proactive measures to mitigate them.

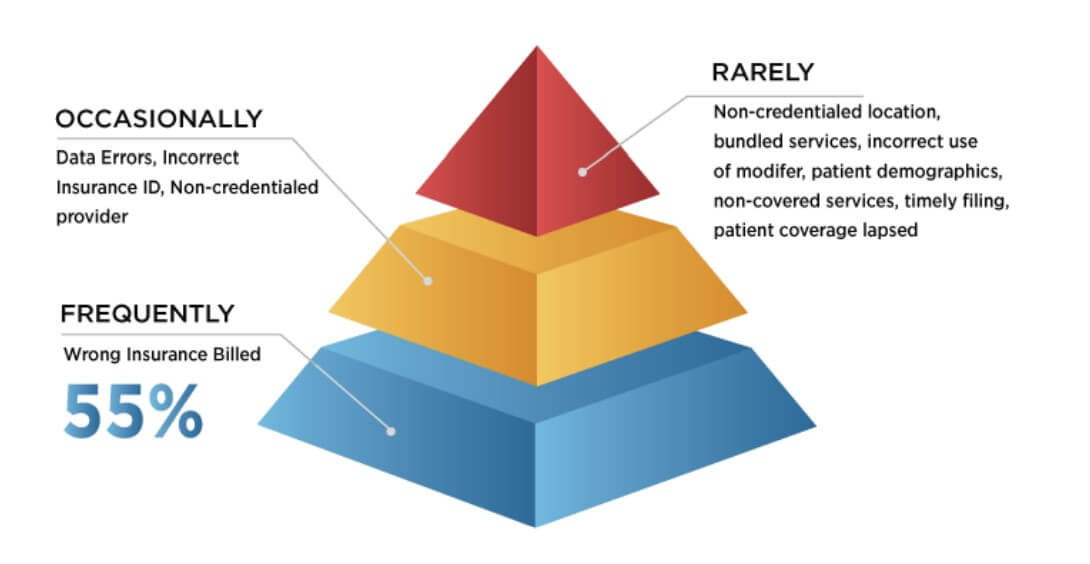

What Causes Write-Offs in Urgent Care?

Source: Urgent Care Association) [1]

- Wrong Insurance Billed: One of the primary reasons for write-offs is insurance claim denials. Insurance companies may refuse to pay claims due to incorrect coding, incomplete documentation, or failure to verify a patient’s insurance eligibility. Even minor errors in coding or missing documentation can lead to claim rejections, forcing urgent care centers to absorb the costs. Additionally, if a patient’s insurance coverage is not verified before treatment, the center may unknowingly provide services that are not covered, leading to revenue losses. Another common issue arises when services are billed to the wrong insurance provider, leading to claim denials and revenue loss. Billing errors, including wrong insurance submissions, contribute significantly to financial losses. In 2023, insured patients accounted for 53% of the estimated $17.4 billion in bad debts written off by healthcare providers. [2] As per a survey by the Urgent Care Association (UCA), the most frequent reason cited for these claim denials is the wrong insurance being billed, with nearly half of all respondents indicating this as their most frequent reason.[3]

- Data Errors: These involve inaccuracies in patient or billing information, such as incorrect coding or demographic details, resulting in claim denials or payment delays. A survey from healthcare technology company Solv. found that 44% of patients enter an incorrect address, which leads to a myriad of clerical issues. Another survey by UCA highlighted that data errors and incorrect insurance ID were reported as an occasional problem about 75% of the time.[4]

- Contractual Write-Offs: These occur when there’s a difference between the provider’s charges and the amount agreed upon with insurance companies. For instance, if your center charges $150 for a service, but the insurer’s allowable fee is $100, the remaining $50 becomes a contractual write-off. While standard in the industry, excessive contractual write-offs can indicate unfavorable payer contracts that may need renegotiation.

- Bad Debt Write-Offs (Healthcare Industry-Wide Problem): This category includes amounts deemed uncollectible due to patient non-payment. Factors contributing to bad debt write-offs include economic hardships faced by patients or ineffective collection processes within the center. Notably, hospitals have observed that as patient balances increase, the likelihood of collection decreases Patient statements with balances greater than $7,500 have more than tripled from 5.2% in 2018 to 17.7% in 2021, leading to higher bad debt write-offs [5]. And according to public accounting firm Crowe, self-pay after insurance accounted for nearly 58% of bad debt in 2021 [6], compared with only 11% in 2018. The rise of high-deductible health plans and higher out-of-pocket medical expenses are a few factors driving this trend.

- Timely Filing Write-Offs: Insurance companies impose deadlines for claim submissions. Failing to file within these timeframes results in denied claims, which then must be written off. In general, medicare requires claims to be filed no later than 12 months after the date of service to be paid.

Strategies to Minimize Write-Offs in Urgent Care

Urgent care centers can reduce write-offs by improving documentation accuracy, strengthening insurance verification, and regularly reviewing payer contracts. Effective patient payment plans, proper provider credentialing, and tracking and managing denials help balance revenue and patient acquisition. Leveraging AI-driven billing systems and automated claim tracking can further enhance efficiency. By addressing these factors, urgent care centers can safeguard financial health while continuing to provide quality patient care.

Time to Introspect

- Have you effectively managed to address the issue of write-offs?

- Is the patient management process at your urgent care centers strong enough to take care of insurance mismatches?

- Are your center’s collection efforts effective in reducing write-offs?

Navikenz has designed solutions for Urgent Care Clinics to streamline revenue cycle management, reduce billing errors, and optimize cash flow. To minimize write-offs and unlock sustainable growth, reach out to us at info@navikenz.com

References:

[1] https://urgentcareassociation.org/wp-content/uploads/Finance-v9.pdf

[2] https://www.definitivehc.com/blog/hospital-bad-debt-statistics-you-need-to-know

[3] https://urgentcareassociation.org/wp-content/uploads/Finance-v9.pdf

[4] https://urgentcareassociation.org/wp-content/uploads/Finance-v9.pdf

[5] https://www.healthcarefinancenews.com/news/claims-denials-rise-complicating-revenue-collection-survey

[6] https://www.crowe.com/-/media/crowe/llp/widen-media-files-folder/h/hospital-collection-rates-for-self-pay-patient-accounts-report-chc2305-001a.pdf

The healthcare industry is undergoing a digital transformation, with urgent care centers increasingly adopting Artificial Intelligence (AI), Machine Learning (ML), and digital initiatives to improve patient care and operational efficiency. While automation, predictive analytics, and AI-driven decision-making promise significant benefits, many urgent care providers struggle with measuring and maximizing their returns on these investments. Understanding the impact of AI and implementing strategies to enhance its effectiveness is crucial for long-term success.

The Current State of AI/ML/Digital Investments in Healthcare

Recent studies indicate a growing commitment to AI and digital technologies within the healthcare sector. Some key statistics highlight the expanding role of AI:

- New AI software is reported to be twice as accurate as professionals in analyzing the brain scans of stroke patients.[1]

- As of 2022, nearly 19% of U.S. hospitals had adopted some form of AI, but only about 4% were high adopters. [2]

- Venture capital investments in AI-driven healthcare in the U.S. are projected to reach $11 billion in 2024, reflecting significant financial backing. [3]

- According to research by Karegon, 40% of U.S. physicians are ready to use generative AI for patient interactions at the point of care in 2024.[4]

These figures highlight both the increasing adoption and substantial investments being made in AI across the healthcare landscape.

AI’s Impact on Operational Efficiency

The integration of AI in urgent care settings has led to significant improvements in efficiency, including reduced administrative burdens, faster patient triage, and enhanced diagnostic accuracy. As per research, AI-powered digital solutions can automate up to 92% of medical care registrations, leading to significant time savings. Though the initial implementation phase may increase screening times by 16% for the first three months, waiting times after automation are reduced by approximately 12 minutes per visit. Over 12 months, this results in an estimated 2,508 hours of saved time.[5] Another study by AI in Healthcare found that AI implementation in radiology practices yielded a 94.13% return on investment, with a breakeven point achieved in just over six months.[6] A 2024 World Economic Forum report on Digital Healthcare Transformation also showcased how digital patient platforms like Huma reduced readmission rates by 30% and time spent reviewing patients by 40%, easing the workload for healthcare providers.[7]

Such examples underscore the immense potential of AI to optimize urgent care operations, leading to better financial and patient outcomes.

How is AI transforming Urgent Care Centers?

AI is revolutionizing urgent care by enhancing efficiency, accuracy, and patient experience. AI-driven triage systems analyze patient symptoms and medical history to prioritize care. Chatbots and virtual assistants collect preliminary data, improving workflow for healthcare providers. AI analyzes medical imaging, lab results, and clinical notes faster than traditional methods, leading to quicker diagnoses and treatment decisions. Predictive AI models help optimize staffing levels based on patient volume forecasts, reducing operational inefficiencies and improving cost-efficiency. AI-powered telehealth solutions enable real-time consultations and remote patient monitoring, reducing unnecessary in-person visits and follow-ups. AI-based clinical decision support systems assist providers with treatment recommendations based on vast medical databases, ensuring evidence-based and high-quality care.

These advancements are reshaping urgent care by reducing costs, improving patient care, and optimizing resource utilization.

Looking Ahead: Measuring and Maximizing ROI

While AI-driven solutions offer promising benefits, healthcare providers must measure their impact effectively to maximize ROI. Key strategies include:

- Performance Metrics: Tracking time savings, cost reductions, and patient outcomes to assess AI efficiency.

- Incremental Implementation: Phased adoption of AI solutions to minimize disruption and enhance long-term adoption.

- Training & Adoption: Ensuring healthcare professionals are trained to use AI tools effectively.

- Continuous Improvement: Leveraging feedback and data analytics to refine AI applications for better patient care and operational efficiency.

Final Thoughts: Are You Ready to Leverage AI for Growth?

The future of urgent care is digital, and AI is at the forefront of this transformation. Healthcare providers must not only invest in AI solutions but also strategize to maximize their returns. As you consider integrating AI into your urgent care center, here are some questions to reflect on:

- What specific pain points in your urgent care center could AI help address?

- Are you tracking the right metrics to evaluate the success of AI adoption?

- How can AI be integrated into your existing workflows without causing disruptions

- Are you getting the RoI you expect from your AI investments?

Navikenz can help you maximize your returns and transform your urgent care operations today. Reach out to us at info@navikenz.com.

References:

[1] https://www.weforum.org/stories/2025/01/ai-transforming-global-health/

[2] https://academic.oup.com/healthaffairsscholar/article/2/10/qxae123/7775605

[3] https://www.weforum.org/stories/2024/11/healthcare-health-ai/

[4] https://www.keragon.com/blog/ai-in-healthcare-statistics

[5] https://pmc.ncbi.nlm.nih.gov/articles/PMC8812142/

[6] https://aiin.healthcare/topics/artificial-intelligence/number-cruncher-quantifies-return-investment-healthcare-ai

[7] https://www.weforum.org/stories/2025/01/ai-transforming-global-health/

The rise of Artificial Intelligence (AI) has sparked widespread debates about its impact on jobs. Many fear that automation will render millions unemployed, replacing human workers with machines. However, history tells a different story. The Industrial Revolution, once feared for displacing jobs, ultimately created entirely new industries and expanded employment opportunities. AI is poised to do the same—enhancing productivity while opening up avenues for work in areas we have yet to identify.

Jevons’ Paradox and AI’s Expanding Role

Microsoft CEO Satya Nadella recently referenced William Stanley Jevons, a 19th-century economist, in discussions about AI’s impact on productivity. Jevons is known for the Jevons Paradox, which suggests that as a resource becomes more efficient and accessible, its overall consumption increases. Applying this to AI, Nadella pointed out that as AI tools become more powerful, they will not replace jobs but will drive more demand for AI-related work, creating an AI-driven economy where human involvement remains essential.

This idea aligns with historical patterns. As steam power revolutionized industries during the Industrial Revolution, rather than reducing employment, it led to rapid industrial growth and new job creation in areas previously unimaginable. AI is now following a similar trajectory.

Historical Parallels: Steam, Mechanization, and the Expansion of Work

The Industrial Revolution provides a blueprint for understanding AI’s long-term effects. When steam power mechanized textile production, many worried that machines would replace workers. Instead, industries flourished.

- Increased Productivity: Mechanized cotton spinning increased output per worker by a factor of 500, while power looms boosted weaving productivity by 40 times. This rapid growth did not eliminate jobs; rather, it created new roles in factory management, logistics, and machine maintenance.

- New Industries Emerged: Innovations like steam-powered cotton gins, which processed 2,500 pounds of lint cotton per day compared to the previous 50-pound limit, allowed for mass production, fueling the expansion of the textile and global trade industries.

- Nail Manufacturing Boom: The invention of Jacob Perkins’ nail-cutting machine in 1795 increased production from 60 nails per hour (manual) to 6,000 nails per hour, making nails affordable and accessible. This innovation didn’t put blacksmiths out of work; instead, it enabled rapid construction growth, increasing demand for builders, carpenters, and engineers.

These technological shifts didn’t reduce the number of jobs available; they transformed the nature of work itself.

AI as a Productivity Booster, Not a Job Killer

AI is following a similar trajectory. Instead of replacing workers, AI is augmenting human capabilities, making tasks more efficient while creating demand for entirely new roles.

- AI-Driven Developer Productivity: AI coding assistants boost developer productivity by 20-35%, helping programmers complete tasks faster and focus on complex problem-solving.

- Generative AI’s Growing Role: By 2024, AI is projected to generate 20% of all code, increasing the efficiency of software development. But instead of replacing developers, it enables them to work on more innovative projects.

- Industry-Wide AI Integration: Wells Fargo’s CFO highlighted that AI will impact every part of banking, not by removing jobs, but by streamlining operations and creating new roles in AI oversight, risk management, and compliance.

The Future of Work: Unidentified Opportunities

AI is currently projected to improve productivity of coding by 20-50%. The Industrial revolution improved productivity of manufacturing 100s of times. But many more people are employed today than in those times.

Much like the Industrial Revolution, AI will change how we work, but it will not eliminate work itself. Instead, it will unlock human potential in ways we have yet to imagine.

By applying Jevons’ Paradox to AI, it becomes clear that increased efficiency will not reduce demand—it will expand it. AI is not the end of work; it is the beginning of an entirely new chapter of human progress.

Insurance fraud is a growing concern worldwide, leading to significant financial losses for insurers and higher premiums for honest policyholders. Fraudulent activities range from exaggerated claims to sophisticated schemes involving organized crime.

According to the Coalition Against Insurance Fraud (CAIF), insurance fraud costs the U.S. approximately $308 billion annually, with life insurance fraud accounting for $75 billion and P&C fraud contributing another $45 billion. Similarly, in India, the estimated loss due to insurance fraud stands at $6 billion per year. Fraudulent claims account for nearly 10% of all insurance payouts worldwide, impacting the financial health of insurers and driving up premiums for genuine policyholders.

Fraud not only affects the insurance industry but also has a wider economic impact, reducing investor confidence, increasing legal and compliance costs, and hindering industry growth.

So, the real question is: What can insurers do to reduce the losses incurred because of fraudulent claims?

Types of fraud

Health Insurance Fraud

Health insurance fraud is one of the costliest types of fraud, where fraudsters exploit the healthcare system by submitting false claims or charging for services never rendered.

- Billing for Unnecessary or Non-Existent Procedures – Some medical providers charge insurers for treatments, tests, or procedures that were never performed.

- Upcoding and Overbilling – Healthcare providers bill for more expensive services than those provided.

- Fake Patients – Fraudsters file claims for deceased or non-existent individuals.

- Prescription Drug Fraud – Some patients obtain prescription drugs under false pretences and sell them illegally.

Auto Insurance Fraud

Auto insurance fraud includes both policyholder fraud and fraud committed by repair shops and third parties.

- Staged Accidents – Fraudsters intentionally cause accidents or fake collisions to collect insurance money.

- Exaggerated Injury Claims – Individuals claim long-term disabilities from minor accidents.

- False Vehicle Damage Reports – Filing multiple claims for the same damage or reporting old damage as a new accident.

- Fake Repair Costs – Auto repair shops inflate repair costs or bill for services that were never done.

Life Insurance Fraud

Life insurance fraud occurs when individuals manipulate policy details, fake deaths, or commit identity fraud to claim benefits.

- Fake Deaths & Staged Disappearances – Some fraudsters fake their own death or a family member’s to claim life insurance payouts.

- Fraudulent Applications – Policyholders lie about their medical history, age, or lifestyle to obtain lower premiums.

Property & Casualty (P&C) Insurance Fraud

Homeowners, business owners, and even service providers engage in fraudulent activities to exploit their policies.

- Arson for Profit – Property owners set fire to homes or businesses to collect insurance money.

- Fake Burglary & Theft Claims – Some claim stolen items that never existed or were never stolen.

- Exaggerated Damage Claims – Policyholders inflate repair estimates after natural disasters or accidents.

Impact of Fraud on Insurers

Insurance fraud has severe consequences for insurers, affecting their financial stability, operations, and customer trust. Key impacts include:

- Financial Losses- Fraudulent claims lead to billions in losses annually, reducing insurers’ profits and financial stability.

- Higher Premiums for Customers-To offset fraud-related losses, insurers increase policy premiums, making insurance more expensive for honest customers.

- Delays in Claim Processing- Fraudulent claims clog the system, causing delays in processing legitimate claims and increasing operational inefficiencies.

- Increased Operational & Compliance Costs- Insurers must invest in fraud detection technologies, investigations, and legal processes, raising overall business costs.

- Damage to Reputation & Customer Trust- Frequent fraud cases erode public confidence, making policyholders hesitant to trust insurance companies.

Strategies for Reducing Fraud Losses

Advanced Technology and AI

- Predictive Analytics: Use data-driven models to detect potentially fraudulent claims based on historical fraud patterns.

- Machine Learning: Develop algorithms that flag suspicious claims by analyzing anomalies and inconsistencies.

- Blockchain: Implement blockchain to ensure data integrity, creating transparent and tamper-proof records that prevent falsified claims.

Claim Verification Processes

- Comprehensive Documentation: Enforce strict documentation requirements and cross-check claims with independent sources.

- Third-Party Verification: Collaborate with independent investigators and experts to verify complex or high-risk claims.

- Enhanced Verification Methods – Utilize biometric authentication, medical history checks, and field investigations.

Employee Training

- Regular Fraud Detection Training: Equip employees with the skills to recognize and prevent fraudulent activities.

- Internal Fraud Awareness: Strengthen corporate governance and monitoring to minimize internal fraud risks.

Collaboration with Law Enforcement

- Partnerships with Law Enforcement: Work closely with authorities to investigate and penalize fraudsters.

- Industry-Wide Data Sharing: Establish databases and fraud detection networks to track fraudulent activities across insurers. The USA has NICB (National Insurance Crime Bureau), while India’s IRDAI is working on a national fraud database.

Public Awareness and Policyholder Education

- Fraud Awareness Campaigns: Educate policyholders about the impact and consequences of insurance fraud.

- Fraud Reporting Tools: Provide platforms for customers to report suspicious activities.

Technological Innovations

- Digital Claim Processing: Automate claims handling with AI-driven tools to reduce errors and identify fraudulent claims early.

- Telematics in Auto Insurance: Use vehicle tracking and driving behavior monitoring to detect staged accidents or exaggerated claims.

- Biometric Verification in Health Insurance: Implement fingerprint or facial recognition to verify patient and provider details, preventing identity fraud. Aadhaar-linked KYC in India enhances verification, while the USA widely uses biometric authentication.

Real-World Fraud Examples

Staged Auto Accident Scam – USA

A fraud ring in Florida staged over 100 fake car accidents, filing fraudulent injury claims that cost insurers nearly $20 million. Fraudsters deliberately caused low-speed crashes, often involving multiple vehicles, and then filed exaggerated injury claims.

Increased scrutiny from FBI and state regulators led to the scam being uncovered.

Fake Death Insurance Scam – India

A family in Uttar Pradesh staged the “death” of a member and produced forged hospital and police records to claim a ₹1 crore life insurance payout. The fraud was exposed when investigators found the “deceased” living in a neighbouring town.

Conclusion

Insurance fraud is a widespread and evolving challenge, threatening financial stability, customer trust, and the overall growth of the insurance sector. While fraudulent claims are difficult to eliminate entirely, advanced AI-driven fraud detection, enhanced verification processes, and increased industry collaboration can significantly mitigate losses.

As fraudsters develop more sophisticated methods, insurers must continually innovate and adapt their fraud prevention strategies. Strong regulatory frameworks, technological advancements, and coordinated industry efforts are essential to ensuring a more transparent, efficient, and fraud-resistant insurance ecosystem.

From the background, Third-Party Administrators (TPAs) are highly instrumental in making sure that there is seamless collaboration between the insurers and the policyholders. This blog highlights in-depth what TPAs are, their functions in the industry of insurance, and juxtapose their functions in India and the USA.

What is a Third-Party Administrator (TPA)?

A TPA is an organization that can provide administrative services to insurance companies, self-employed business entities, and other stakeholders.

Their main functions include but are not limited to claims processing, policy administration, customer service management, and other compliance services. In summary, by relieving insurance companies from these functions, TPAs help meet the needs of policyholders in a timely and cost-effective manner.

Role of TPAs in the Insurance Industry

TPAs perform a host of other important functions within the insurance industry:

- Claims Processing: The third-party administrators (TPAs) have the responsibility of ensuring the processing of insurance claims fairly and efficiently by handling the claims verification and management tasks.

- Policy Administration: TPAs facilitate the issue, update, and renewal of policies to ensure policies are not out of date or infringe on regulations.

- Customer Support: TPAs are the first point of contact to policyholders to aid with questions, requests, and even conflict resolutions.

- Regulatory Compliance: A TPA acts as an intermediary, looking at both ends of the business to ensure all legal and regulatory obligations of the insurer, and the insured are met.

- Network Management: They build and maintain the network of health care service providers, other relevant parties, and other stakeholders to expand the limit of the policyholder’s reach.

The Importance of TPAs in Claims Processing & Management

The core purpose of a TPA is to manage the claims process, making it as simple and fast as possible. Their tasks are completed with utmost transparency. They take care of all the repetitive work for the insurers which leads to lower operational costs and more effective risk management. TPAs also actively participate in ensuring settlement of claims is just and reasonable to eliminate customer or insurance fraud, and to enhance service quality.

Comparison of TPA Licensing in India and the US

India and the United States have clearly defined requirements for TPAs to be licensed, though the details may vary across states.

TPA Licensing Requirements in India

In India, TPAs are regulated by the Insurance Regulatory and Development Authority of India (IRDAI). It is a fact that TPAs are regularly audited, and the regulatory body ensures that TPAs are upholding best-in-class service. Important licensing requirements that apply include:

- TPA Company should be a registered firm under Companies Act, 2013.

- It requires a minimum paid-up capital of INR 1 Crore.

- For operational approval, IRDAI approval is also required.

- TPAs should only conduct TPA activities and should not engage in other business.

TPA Licensing Requirements in the US

TPA regulations differ by state in the United States. However, there are general guidelines most states demand, such as:

- Compliance with NAIC standards.

- State Insurance Department registration.

- TPA Company Background checks and financial stability.

- Surety bonds required as a guarantee in some states.

- Regulatory Compliance: TPAs are required to adhere to regulations such as HIPAA (Health Insurance Portability and Accountability Act) and ERISA (Employee Retirement Income Security Act) to maintain privacy and security.

Top TPA Organizations in India

The Indian market has a growing number of TPA providers that offer a variety of services, especially in health insurance. Some of the top players in India include:

- Medi Assist Insurance TPA Private Limited

- MDIndia Health Insurance TPA Private Limited

- Paramount Health Services & Insurance TPA Private Limited

- Heritage Health Insurance TPA Private Limited

- Raksha Health Insurance TPA Private Limited

- Vidal Health Insurance TPA Private Limited

- Genins India Insurance TPA Limited

These companies are key contributors to the growing Indian health insurance sector, helping streamline claims processing and improving the overall insurance experience for policyholders.

Top TPA Players in the US

In the US, the TPA market is well-established, with many large firms offering comprehensive services. Some of the leading TPAs in the US include:

- Sedgwick Claims Management Services

- Crawford & Company

- Maritain Health

- Gallagher Bassett Services

- CorVel Corporation

- Helmsman Management Services LLC

These companies provide claims management, risk assessment, and fraud detection services, ensuring the efficiency and integrity of the US insurance market.

Claims adjudication and management are critical processes in the insurance industry, yet they are often burdened with inefficiencies, long turnaround times, and the risk of fraud. Traditional claims processing involves extensive paperwork, manual reviews, and delays that impact both insurers and policyholders.

With the advent of Agent AI, insurers can now optimize these processes through automation, data-driven decision-making, and advanced fraud detection. According to McKinsey, AI-driven claims processing can reduce operational costs by 30% and increase efficiency by 50%

In this blog, we will explore how Agent AI can revolutionize the claims adjudication and management workflows, providing insurers with the ability to reduce costs, increase efficiency, and improve customer satisfaction.

What is Agent AI?

Agent AI refers to artificial intelligence systems designed to automate and optimize complex business processes, particularly in industries like insurance, customer service, and finance. These AI-driven agents use machine learning, natural language processing (NLP), and advanced analytics to assist human professionals, streamline workflows, and improve decision-making.

How Agent AI Transforms Claims Adjudication and Management

Speeding Up Claims Processing

Traditional claims adjudication can take days, if not weeks, due to manual data entry, document review, and communication with third parties.

Agent AI automates many of these tasks, including data extraction, document verification, and fraud detection. AI-powered claims processing has been shown to reduce settlement time by 50-70%, with AI-driven systems processing claims in as little as 3-5 days, compared to the traditional 15-30 days.

For example, An AI-driven insurer leverages automation to process simple claims in under three minutes. By enhancing speed and accuracy in claim processing, insurers can significantly reduce resolution times, ensuring customers receive timely payouts.

Enhancing Accuracy and Reducing Human Error

Manual data handling often introduces errors in claims management, which can lead to costly mistakes or delays. Studies indicate that manual claim processing has an error rate of 10-15%, leading to disputes and inefficiencies.

Agent AI can automatically cross-check data, validate claim details, and assess the legitimacy of claims based on pre-set rules and historical data, reducing human error by up to 90%. This minimizes the risk of inaccuracies, improving the overall accuracy of claims adjudication and ensuring fairer outcomes for both insurers and policyholders.

Fraud Detection and Prevention

Fraud is a major concern for insurers, often resulting in substantial losses. Insurance fraud accounts for 10% of total claims costs, making fraud detection a top priority.

Agent AI uses advanced machine learning algorithms to analyze patterns of fraudulent behavior, flagging suspicious claims before they are processed. AI-powered fraud detection systems can identify fraudulent claims with 90-95% accuracy by recognizing anomalies, correlating data from various sources, and detecting inconsistencies that may suggest fraudulent activity. This proactive approach helps prevent fraudulent claims, safeguarding insurers’ financial stability.

Intelligent Claim Routing

AI can optimize the workflow by intelligently routing claims to the appropriate adjusters or departments based on the complexity of the case and available resources.

For example, intelligent AI-driven claim routing has been found to reduce handling time by 30-40%, while auto-processing simple claims increases efficiency by 20-30%. Simple claims can be handled by automated systems, while more complex claims requiring human intervention are directed to skilled claims adjusters. This ensures that resources are allocated efficiently, improving turnaround times and reducing backlogs.

Personalized Customer Interactions

Customer satisfaction is key to retaining policyholders, and AI-driven automation has been shown to improve customer satisfaction (CSAT) scores by 35%.

Agent AI can be integrated with chatbots or virtual assistants, enabling insurers to provide 24/7 support to customers. AI-powered chatbots reduce customer inquiries by 40%, freeing up human agents. These AI-driven solutions can answer queries, provide updates on claim status, and guide customers through the claims process, all while personalizing interactions based on the customer’s history and preferences.

Predictive Analytics for Future Claims Management

Agent AI uses predictive analytics to forecast trends and potential risks. By analyzing historical claims data, AI can help insurers anticipate claims surges or identify emerging risks in real-time. This enables proactive claims management, helping insurers make better-informed decisions about claim settlements, resource allocation, and risk mitigation strategies.

Predictive AI has been found to reduce claim costs by 15-20% by identifying risk patterns and improving forecasting accuracy, ensuring better resource planning and preventing unexpected claim surges.

Conclusion

The insurance industry is undergoing a digital revolution. Is your company leveraging Agent AI to stay ahead, reduce fraud, and enhance customer satisfaction? The future is here—insurers who embrace AI today will lead the market tomorrow. By optimizing claims adjudication and management processes, insurers can not only improve efficiency and accuracy but also enhance the customer experience, reduce fraud, and ensure a more sustainable business model in the long term.

The future of insurance is digital, and Agent AI is at the forefront of this transformation.