Urgent care centers play a vital role in providing accessible and efficient healthcare. However, many of them struggle with revenue losses due to write-offs. These write-offs significantly impact financial stability, reducing profitability and hindering growth. To maintain financial health, urgent care providers must understand the primary causes of write-offs and take proactive measures to mitigate them.

What Causes Write-Offs in Urgent Care?

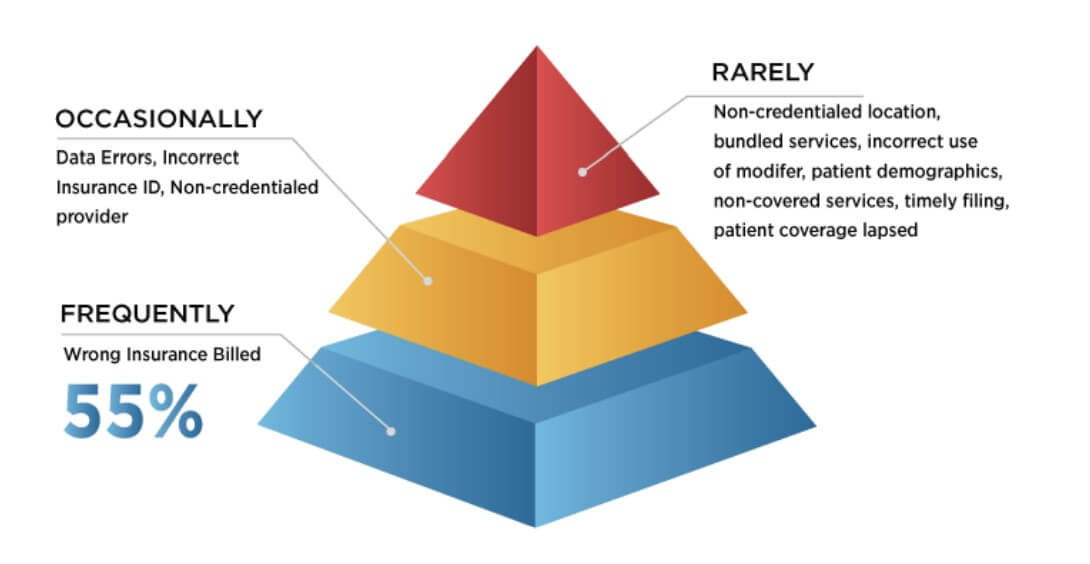

Source: Urgent Care Association) [1]

- Wrong Insurance Billed: One of the primary reasons for write-offs is insurance claim denials. Insurance companies may refuse to pay claims due to incorrect coding, incomplete documentation, or failure to verify a patient’s insurance eligibility. Even minor errors in coding or missing documentation can lead to claim rejections, forcing urgent care centers to absorb the costs. Additionally, if a patient’s insurance coverage is not verified before treatment, the center may unknowingly provide services that are not covered, leading to revenue losses. Another common issue arises when services are billed to the wrong insurance provider, leading to claim denials and revenue loss. Billing errors, including wrong insurance submissions, contribute significantly to financial losses. In 2023, insured patients accounted for 53% of the estimated $17.4 billion in bad debts written off by healthcare providers. [2] As per a survey by the Urgent Care Association (UCA), the most frequent reason cited for these claim denials is the wrong insurance being billed, with nearly half of all respondents indicating this as their most frequent reason.[3]

- Data Errors: These involve inaccuracies in patient or billing information, such as incorrect coding or demographic details, resulting in claim denials or payment delays. A survey from healthcare technology company Solv. found that 44% of patients enter an incorrect address, which leads to a myriad of clerical issues. Another survey by UCA highlighted that data errors and incorrect insurance ID were reported as an occasional problem about 75% of the time.[4]

- Contractual Write-Offs: These occur when there’s a difference between the provider’s charges and the amount agreed upon with insurance companies. For instance, if your center charges $150 for a service, but the insurer’s allowable fee is $100, the remaining $50 becomes a contractual write-off. While standard in the industry, excessive contractual write-offs can indicate unfavorable payer contracts that may need renegotiation.

- Bad Debt Write-Offs (Healthcare Industry-Wide Problem): This category includes amounts deemed uncollectible due to patient non-payment. Factors contributing to bad debt write-offs include economic hardships faced by patients or ineffective collection processes within the center. Notably, hospitals have observed that as patient balances increase, the likelihood of collection decreases Patient statements with balances greater than $7,500 have more than tripled from 5.2% in 2018 to 17.7% in 2021, leading to higher bad debt write-offs [5]. And according to public accounting firm Crowe, self-pay after insurance accounted for nearly 58% of bad debt in 2021 [6], compared with only 11% in 2018. The rise of high-deductible health plans and higher out-of-pocket medical expenses are a few factors driving this trend.

- Timely Filing Write-Offs: Insurance companies impose deadlines for claim submissions. Failing to file within these timeframes results in denied claims, which then must be written off. In general, medicare requires claims to be filed no later than 12 months after the date of service to be paid.

Strategies to Minimize Write-Offs

Urgent care centers can reduce write-offs by improving documentation accuracy, strengthening insurance verification, and regularly reviewing payer contracts. Effective patient payment plans, proper provider credentialing, and tracking and managing denials help balance revenue and patient acquisition. Leveraging AI-driven billing systems and automated claim tracking can further enhance efficiency. By addressing these factors, urgent care centers can safeguard financial health while continuing to provide quality patient care.

Time to Introspect

- Have you effectively managed to address the issue of write-offs?

- Is the patient management process at your urgent care centers strong enough to take care of insurance mismatches?

- Are your center’s collection efforts effective in reducing write-offs?

Navikenz has designed solutions for Urgent Care Clinics to streamline revenue cycle management, reduce billing errors, and optimize cash flow. To minimize write-offs and unlock sustainable growth, reach out to us at [email protected]

References:

[1] https://urgentcareassociation.org/wp-content/uploads/Finance-v9.pdf

[2] https://www.definitivehc.com/blog/hospital-bad-debt-statistics-you-need-to-know

[3] https://urgentcareassociation.org/wp-content/uploads/Finance-v9.pdf

[4] https://urgentcareassociation.org/wp-content/uploads/Finance-v9.pdf

[5] https://www.healthcarefinancenews.com/news/claims-denials-rise-complicating-revenue-collection-survey

[6] https://www.crowe.com/-/media/crowe/llp/widen-media-files-folder/h/hospital-collection-rates-for-self-pay-patient-accounts-report-chc2305-001a.pdf