NVISIONTM – Creating new possibilities for businesses through advanced image processing solutions

NVISIONTM is a technology suite from Navikenz bringing a rich collection of advanced image processing solutions offering a variety of possibilities to meet the present and emerging business needs.

NVISIONTM brings a rich collection of image processing capabilities including image analysis, image matching, optical character recognition (OCR) for text extraction, object detection, object extraction and liveness detection. These capabilities can help organizations detect identity of people, control access to their work facilities, enhance security and pro-actively identify potential frauds and prevent or mitigate impact. It is powered by advanced artificial intelligence and machine learning capabilities available through Amazon Bedrock, Amazon Rekognition and Amazon Textract.

Features available in NVISIONTM

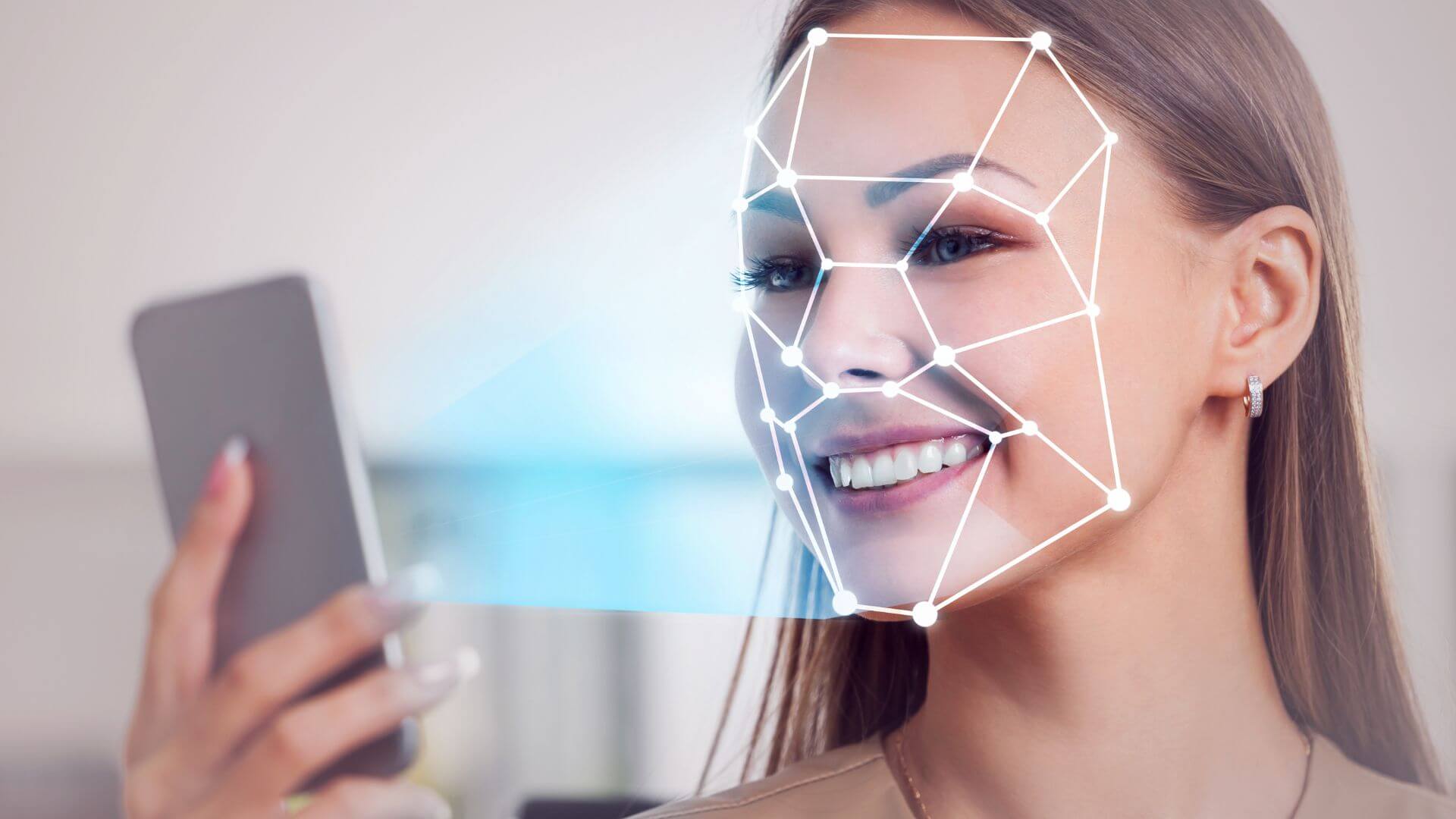

Real-time identity verification

Captures live images of a person’s face and cross-verifies them with available identity documents such as Passports, Drivers licence, or National identity cards. This helps verify and confirm identity of a person to guide decisions in allowing access to controlled facilities including airports, financial institutions, hospitals among other areas

Advanced image analysis

Can process and analyze images of a wide range of real-life objects and documents, enabling businesses to identify similarities or differences against a predefined collection. Improves accuracy and efficiency of matching real-time photos with stored records to ensure that submitted documents are authentic

Liveness detection

Can verify and confirm if the person in front of screen is a live person or a photograph, and whether the person matches the picture in the stored document. It helps prevent spoofing and bad actors

Fraud detection and prevention

Can verify the authenticity of physical documents presented during remote processes like ‘Know your customer’ (KYC) verification. It identifies and prevents use of digital images of documents from mobile phones, ensuring that only genuine, physical documents are accepted

Scalable and secure

It is built over the robust infrastructure of Amazon Rekognition and provides scalable solutions for businesses of all sizes. It ensures high levels of accuracy, security, and performance, making it suitable for enterprise-grade deployments

Benefits offered by NVISIONTM

Enhanced security

Improves security across multiple business functions, from access control to user authentication, minimizing the risk of unauthorized access or fraud by leveraging real-time facial recognition and document cross-verification capabilities

Fraud detection and mitigation

Businesses can detect and prevent potential fraud by ensuring that individuals are who they claim to be. Ability to verify live photos and detect fake documents ensures authenticity of transactions and onboarding processes, reducing potential identity theft and financial fraud

Improved efficiency

Automating identity verification and document processing reduces manual intervention and human errors, leading to faster and more efficient operations, especially in high-volume environments like airports, banking, and e-commerce

Regulatory compliance

Aids businesses in meeting regulatory requirements, particularly in sectors like finance and healthcare, where stringent KYC and data privacy laws mandate secure identity verification and document processing

Customizable and adaptable

Can be tailored to specific industry needs, allowing organizations to adopt and use it for a variety of business needs. Modular and open standards based design will allow organizations to seamlessly integrate the capabilities into existing business processes with minimal disruption.

Sample real-life scenarios to use NVISIONTM

Airports and travel

Streamline passenger identity checks by verifying real-time facial images against stored passports or travel documents, expediting the check-in and boarding process while strengthening security

Online proctoring

Educational institutions and certification bodies can proctor online examinations, ensuring that the individual taking the online test matches the stored identity record, preventing impersonation and maintaining exam integrity

Financial services and KYC

Enhance accuracy and reliability of remote KYC verification processes by ensuring that individuals present authentic physical documents, preventing fraud during account opening, loan processing, and insurance claims

Healthcare and patient verification

Healthcare providers can more reliably verify patient identities for secure access to medical records, telemedicine consultations, and to ensure proper treatment and billing

Corporate access control

Organizations can verify employees’ or visitors’ identities in real time before granting access to secure buildings, data centers, or sensitive areas.

With NVISIONTM, Navikenz is empowering businesses to secure their operations, enhance customer trust, and streamline processes, with state-of-the-art technology artificial intelligence and machine learning capabilities.

Click here to download the brochure and explore how our solution can transform your business!